All Categories

Featured

Table of Contents

It's essential to understand that accomplishing certified capitalist status is not a single achievement. It's for that reason vital for accredited financiers to be positive in monitoring their monetary situation and updating their records as required.

Failure to meet the recurring criteria may result in the loss of recognized investor condition and the associated privileges and chances. While a number of the financial investment kinds for Accredited Capitalists are the exact same as those for any individual else, the specifics of these financial investments are often different. Personal placements describe the sale of protections to a choose group of recognized financiers, normally outside of the general public market.

Personal equity funds swimming pool funding from accredited investors to acquire ownership risks in business, with the goal of boosting efficiency and generating substantial returns upon exit, normally through a sale or preliminary public offering (IPO).

Market changes, building monitoring obstacles, and the possible illiquidity of actual estate assets need to be carefully reviewed. The Securities and Exchange Commission (SEC) plays an essential role in managing the tasks of certified financiers, who have to abide by specifically laid out policies and reporting demands. The SEC is liable for imposing protections regulations and laws to secure investors and keep the integrity of the monetary markets.

Most Affordable Accredited Investor Real Estate Investment Networks

Guideline D provides exemptions from the registration needs for specific exclusive positionings and offerings. Approved capitalists can join these exempt offerings, which are typically included a restricted variety of advanced financiers. To do so, they should give precise info to companies, total needed filings, and comply with the policies that control the offering.

Compliance with AML and KYC needs is vital to maintain standing and gain accessibility to different financial investment opportunities. Falling short to adhere to these regulations can bring about extreme fines, reputational damages, and the loss of certification opportunities. Allow's debunk some typical false impressions: An usual false impression is that certified investors have a guaranteed advantage in regards to investment returns.

Preferred Accredited Investor Platforms

Yes, recognized capitalists can shed their condition if they no more meet the qualification criteria. If a certified capitalist's revenue or web well worth falls below the designated limits, they may shed their accreditation. It's crucial for recognized financiers to regularly assess their monetary situation and report any type of changes to guarantee compliance with the laws

Some investment possibilities may allow non-accredited financiers to get involved through specific exceptions or arrangements. It's essential for non-accredited investors to very carefully examine the terms and problems of each financial investment opportunity to identify their eligibility. accredited investor alternative asset investments.

Reputable Accredited Investor Passive Income Programs

If you want to buy certain complex investments, the Stocks and Exchange Commission (SEC) calls for that you be an accredited investor. To be certified, you should fulfill specific needs regarding your wealth and revenue along with your investment knowledge. Have a look at the basic demands and advantages of becoming a recognized financier.

The SEC considers that, due to their economic security and/or investment experience, certified financiers have much less demand for the defense offered by the disclosures called for of regulated investments. The guidelines for credentials, which have actually been in location since the Stocks Act of 1933 was established as an action to the Great Anxiety, can be discovered in Law D, Policy 501 of that Act.

Unparalleled Accredited Investor Alternative Asset Investments

That company can not have actually been created simply to acquire the unregistered safeties in question. These requirements of revenue, web well worth, or professional experience make certain that inexperienced financiers don't risk cash they can not manage to shed and don't take financial risks with financial investments they do not understand. No actual accreditation is readily available to validate your status as an accredited capitalist.

When you seek recognized investor condition, you're most likely to undergo a screening procedure. Papers you will possibly have to generate might consist of: W-2s, tax returns, and various other papers validating profits over the past two years Financial statements and bank declarations to confirm web worth Credit records Documents that you hold a FINRA Series 7, 64 or 82 classification Paperwork that you are a "educated worker" of the entity releasing the safeties The capability to invest as a "educated staff member" of a fund releasing safeties or as a financial expert holding an ideal FINRA license is brand-new as of 2020, when the SEC broadened its interpretation of and qualifications for certified capitalists.

Top-Rated Venture Capital For Accredited Investors for Accredited Investor Platforms

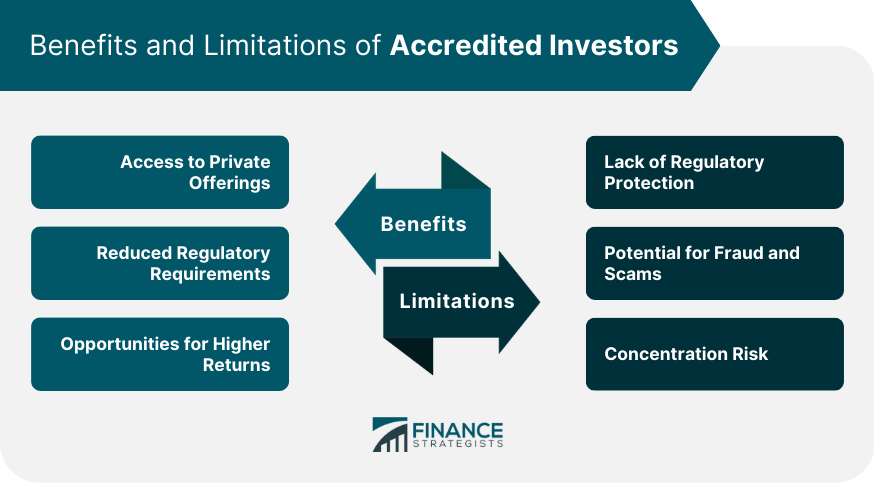

These safeties are unregistered and unregulated, so they do not have available the regulatory defenses of registered safeties. In basic, these financial investments may be specifically unstable or bring with them the potential for substantial losses. They include different structured investments, hedge fund financial investments, exclusive equity financial investments, and other private placements, all of which are uncontrolled and might bring substantial threat.

Of training course, these financial investments are likewise appealing due to the fact that in enhancement to included risk, they bring with them the potential for considerable gains, normally higher than those offered by means of ordinary investments. Accredited capitalists have offered to them financial investments that aren't available to the public. These financial investments include exclusive equity funds, angel financial investments, specialty financial investments such as in hedge funds, equity crowdfunding, property investment funds, venture funding financial investments, and straight investments in oil and gas.

Business offering unregistered safety and securities only need to offer documentation concerning the offering itself plus the area and police officers of the firm using the safeties (exclusive investment platforms for accredited investors). No application procedure is required (as holds true with public supply, bonds, and common funds), and any kind of due diligence or additional info supplied depends on the firm

Respected Accredited Investor Alternative Investment Deals

This information is not intended to be specific advice. Possible individuals should talk to their individual tax obligation specialist pertaining to the applicability and effect of any kind of and all advantages for their own individual tax circumstance. Additionally, tax obligation regulations change every now and then and there is no guarantee pertaining to the interpretation of any kind of tax legislations.

Certified investors (sometimes called qualified investors) have accessibility to investments that aren't readily available to the general public. These financial investments could be hedge funds, difficult money lendings, exchangeable investments, or any various other security that isn't signed up with the financial authorities. In this article, we're going to concentrate particularly on property investment choices for accredited capitalists.

Latest Posts

Government Property Tax Auctions

How To Start Tax Lien Investing

Investing In Tax Liens And Deeds